Enforcement Order Automation in Banks: An Investment That Pays Off in Three Years

In 2023, European debt collection firms handled receivables worth approximately €19.6 billion, with key markets such as Germany and the UK leading the sector.1 In Germany, debt collection agencies are estimated to manage over €50 billion in outstanding receivables, emphasising the scale of debt-related operational challenges in large European economies.2 The scale of the debt management challenge in the financial sector is growing rapidly, and with it, the pressure on banks to improve operational efficiency, regulatory compliance and data protection. In this context, automating enforcement order processes becomes not only a cost-optimisation tool, but also a critical component of risk mitigation and organisational resilience strategies.

The Scale of Challenges in Enforcement Management

Managing enforcement order processes in banking today requires more than just organisational efficiency – it demands integrated systems that ensure fast and error-free execution at every stage.

Traditional, manual debt servicing models often lead to delays, increased operational costs and a higher risk of errors and regulatory penalties.

In response, financial institutions are increasingly investing in dedicated IT solutions that automate enforcement-related operations. Modern banking platforms like Altkom Digital Banking Platform not only speed up processes but also ensure full compliance with legal requirements and optimise internal resources.

How Does the Enforcement Process Work?

Debt management in banking involves not only ongoing monitoring of repayments and recovery actions but also, in specific cases, the sale or assignment of receivables. In enforcement procedures, banks are responsible for blocking and transferring funds to enforcement authorities in accordance with received instructions, observing deadlines and rules such as resolving overlapping enforcement claims.

Key Stages of Bank Account Seizure

The process begins when the bank receives a notice from an enforcement authority – either a court bailiff or a public administration body. This notice may be delivered in paper or electronic form.

Upon receipt, the bank undertakes the following steps:

- Blocks the client’s account funds up to the amount specified in the enforcement order;

- Transfers the seized funds to the enforcement authority’s account within seven days of the funds being deposited into the seized account;

- Informs the authority if the seizure cannot be executed, e.g. due to identification issues.

In cases involving foreign currency accounts, it converts funds to the local currency using the applicable buying rate.

If multiple enforcement authorities attempt to seize the same account (enforcement overlap), the bank halts transfers and notifies all parties. Funds are only released once the competent authority for joint enforcement is confirmed.

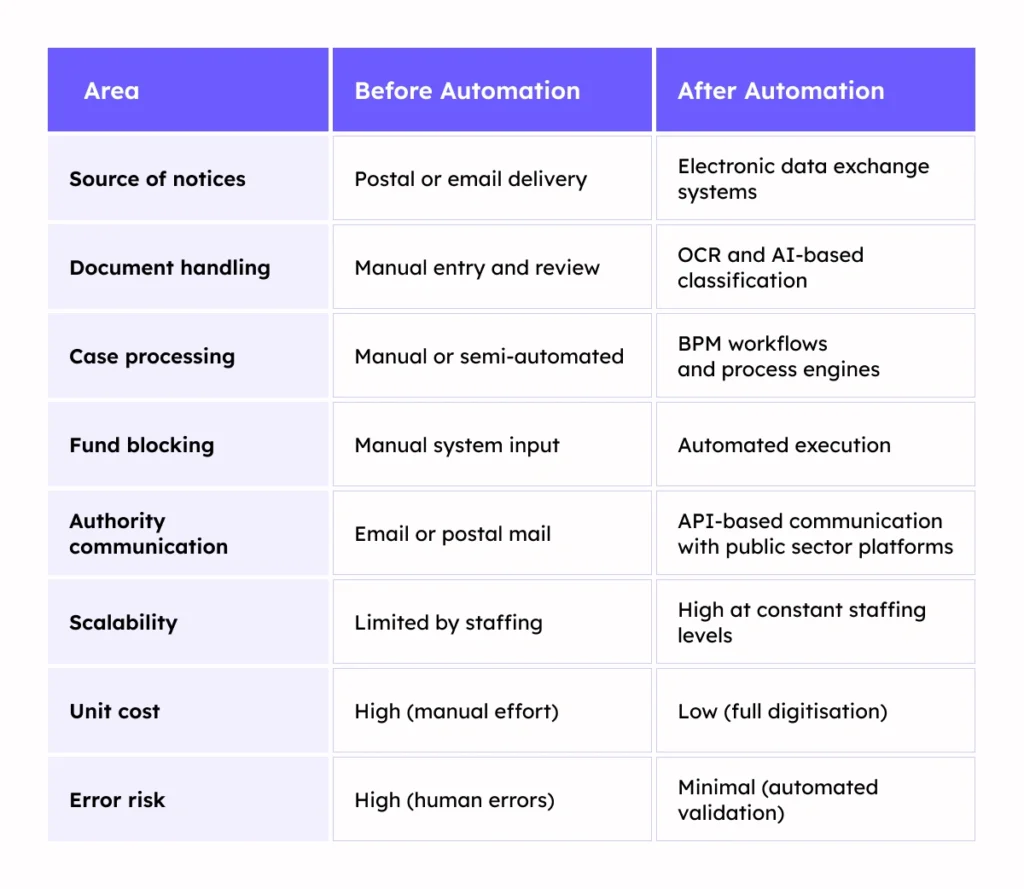

Automation as a Foundation of Operational Efficiency

Modern debt management requires more than process reorganisation – it needs comprehensive automation through advanced IT systems. Integration across technologies into one consistent operational ecosystem is crucial.

Systems Supporting Automation

Automation implementation typically involves the integration of the following components:

- Core banking systems – providing access to the account and customer data required for seizure processing;

- Dedicated enforcement modules – allowing automated fund blocking and communication with enforcement authorities;

- Integration with external platforms – such as government bailiff registries, digital communication gateways, business registers and social security systems – enabling fast and secure data exchange. Examples include Germany’s SAFE and EGVP, the UK’s HMCTS and Companies House API or pan-European networks like e-CODEX;

- Workflow BPM systems – e.g. Camunda, to automate process flows, enforce task order and handle exceptions;

- CRM and document repositories – for managing enforcement communication and documentation.

Process Steps That Can Be Automated

Looking at the model outlined above, several stages are suitable for automation using the right tools and systems:

- Receiving notices – automated document retrieval via national e-enforcement systems or bailiff communication portals;

- Document classification – using AI and OCR to identify document types (e.g. individual account seizure) and assign categories;

- Assigning to workflows – triggering BPM rules automatically (e.g. Camunda);

- Client and account identification – instant matching using PESEL, NIP or other identifiers;

- Exemption amount checks – automated review of protected balances;

- Currency conversion – automatic exchange based on the current buying rate;

- Fund blocking – fully automatic, without employee involvement;

- Response generation and delivery – auto-generated documents sent electronically;

- Exception handling – manual involvement only in non-standard cases (e.g. legal disputes or client requests).

As a result, average handling time per case drops to just a few minutes, with a single employee capable of processing up to 10,000 cases monthly. This reduces per-case costs to under PLN 1 (a Polish benchmark, which in international contexts translates to below 1 euro or dollar per case).

Operational Issues in Manual Enforcement Handling

Manual enforcement procedures expose banks to various organisational and technical obstacles:

- Receiving notices via post or email, requiring manual registration;

- Manual task assignment without workflow support;

- Manual customer data lookup, prolonging processing and increasing risk of error;

- Manual verification of protected amounts;

- Manual blocking of funds in accounting systems, increasing the chance of mistakes;

- Manually editing templates in Word to communicate with enforcement authorities;

- Physically handling correspondence (printing, signing, scanning, mailing).

The lack of automation in these areas leads to longer processing times, higher per-case costs and a greater risk of operational errors and missed statutory deadlines.

Manual Model Efficiency Overview

- Average time per case: 1 to 2 working days.

- Staff capacity: several hundred cases monthly.

- Per-case cost: PLN 5 to 15, depending on workload and correspondence method.

Benefits of Enforcement Process Automation

Enforcement order automation delivers measurable financial and operational benefits within both short- and long-term perspectives.

Scalable without Increased Costs

Automation enables growing volumes of enforcement tasks without proportional staffing increases. Banks can efficiently handle thousands of cases monthly – ideal for M & A scenarios or rapid portfolio expansion.

Improved Control and Reporting

Each case is tracked from receipt to fund transfer. Automated processes generate accurate reports for management, regulators (e.g. FCA, SEC) and auditors – reducing compliance risk.

Use of AI and OCR Technologies

AI and OCR solutions enable automated classification of even unstructured documents (e.g. scanned PDFs), significantly reducing the need for manual intervention and allowing near-total automation for standard cases.

Expandable Infrastructure

Automation infrastructure used in enforcement can be scaled to other processes such as:

- Lifting enforcement orders;

- Complaint handling;

- Pre-collection debt management.

This extends ROI and accelerates digital transformation.

Example ROI from Automation

Implementing automation for enforcement order handling is not just a process optimisation effort, but also a strategic investment expected to deliver measurable financial benefits. To make an informed assessment of a project’s viability, it’s essential to evaluate the potential operational savings and the return on investment.

Below is a sample ROI estimate for a typical cooperative bank. While this model is based on Polish operational data and currency, the underlying cost dynamics and savings potential apply broadly across markets, with similar returns achievable in euro-, dollar- or other currency-based systems.

ROI Assumptions:

- Enforcement orders per month: 1,000

- Manual cost per case: PLN 8

- Automated cost per case: PLN 1.5

- Implementation cost (workflow + OCR + integration with bailiff/enforcement platform): PLN 150,000

- Annual maintenance cost: PLN 20,000

Operational Savings

- Saving per case: PLN 6.5

- Monthly saving: PLN 6,500

- Annual saving: PLN 78,000

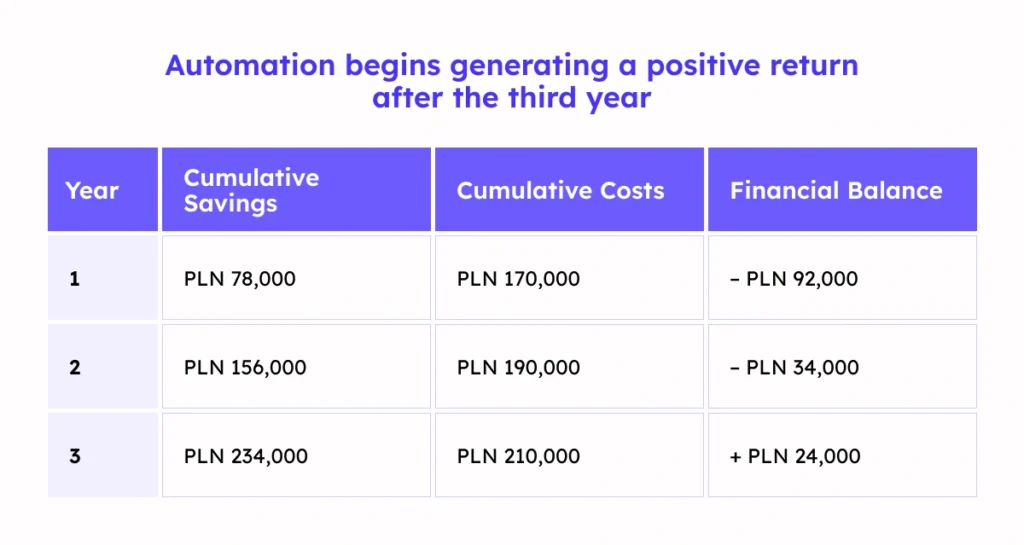

Return on Investment and Financial Balance

- Total costs in the first year: PLN 150,000 (implementation) + PLN 20,000 (maintenance) = PLN 170,000

- Balance after the first year: PLN 78,000 (savings) – PLN 170,000 (costs) = –PLN 92,000 (no return yet)

3-Year ROI Outcome

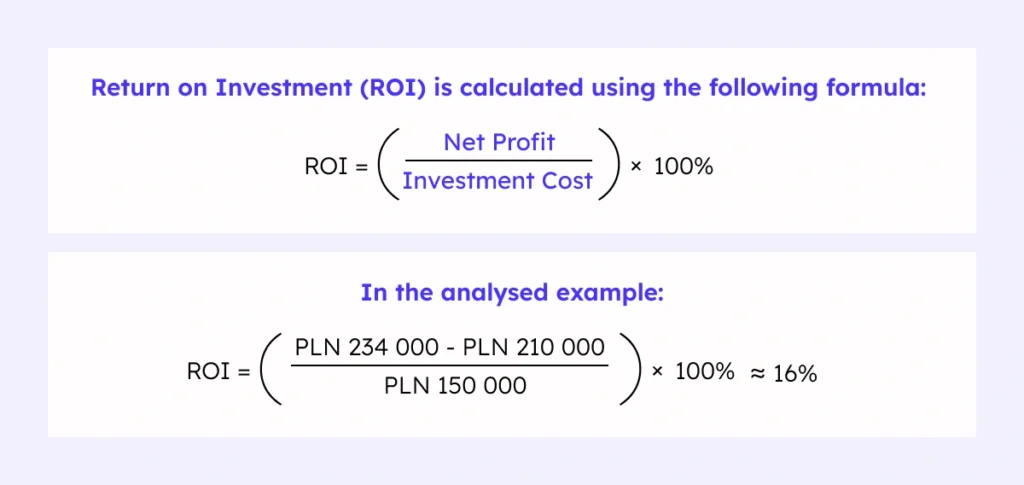

This means that within three years of implementation, enforcement process automation yields a positive ROI of approximately 16%. In other words, the investment begins to generate a net financial return after the third year of operation.

Summary

In today’s regulatory and operational landscape, banks must strive to maximise process efficiency while reducing costs and the risk of errors. Manual handling of enforcement orders results in high per-case costs (PLN 5–15), prolonged case duration (1–2 working days) and increased risk of non-compliance with supervisory requirements.

Automation enables:

- Cost reductions of up to 80%;

- Case processing time cut to minutes;

- High-volume processing without added staff;

- Full auditability and reduced regulatory risk.

ROI analysis confirms that enforcement process automation can deliver a positive financial return in three years – with growing benefits thereafter.

Banks that take this step not only gain immediate savings, but also long-term gains in operational resilience and compliance readiness.

Next Steps and Collaboration

Implementing automation should begin with an operational audit to assess current costs, efficiency and risk levels.

If you’re considering process optimisation, our experts can help you assess potential benefits and design a tailored solution for your institution.