10-fold increase in loan sales thanks to automation of the decision-making process

OUTCOMES

Results of partnership

Decision-driven

analytics

Access to user data enabled continuous improvement of the application form and increased process efficiency.

Sales volume

growth

More than a tenfold increase in credit approvals following process optimisation and automation deployment.

Conversion risk

management

Real-time monitoring and recovery of abandoned credit applications within the digital journey.

PROJECT

Genesis and business expectations

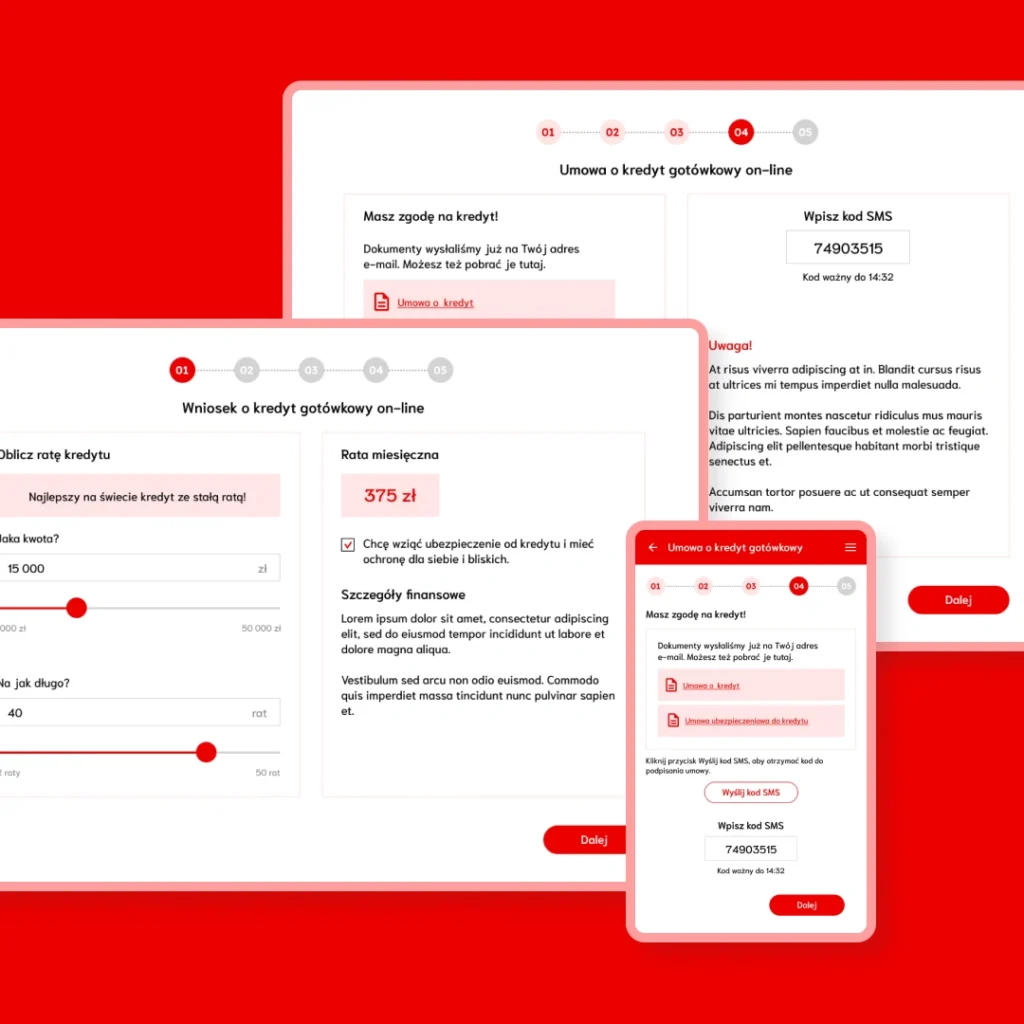

The project focused on the design and implementation of an online credit application solution, integrated with e-commerce platforms and supporting the financing of consumer purchases. The Polish branch of a global consumer bank approached Altkom Software with a request to deliver a comprehensive solution based on Camunda technology.

The delivered platform was built on Altkom’s proprietary product – the Digital Banking Platform – which leverages Camunda as its core process engine. This approach enabled significantly faster and more efficient management of process automation, as well as accelerated deployment of new functionalities.

PROJECT TIME

2019 – present

INDUSTRY

Banking

COUNTRY

Poland

SERVICES AND SOLUTIONS

TECHNOLOGIES

Camunda

Angular

Java

Oracle

Elasticsearch

OpenShift

Apache Kafka

Apache Camel

Who have we helped?

Our client is a leading consumer finance company with a presence in 16 European countries. More than 14,500 employees provide financial products and services to 18 million customers at 130,000 points of business partners.

Business challenges

The client identified several strategic areas for optimisation:

- Streamlining sales processes for instalment loans and cash loan servicing in the online channel;

- Reducing the involvement of the Call Centre team in the execution of sales processes;

- The ability to quickly implement a new product – a cash loan – available to both existing and new customers;

- Capturing data on users who have abandoned the application process for further analysis and optimisation of the conversion path.

ACTIONS

Project execution process

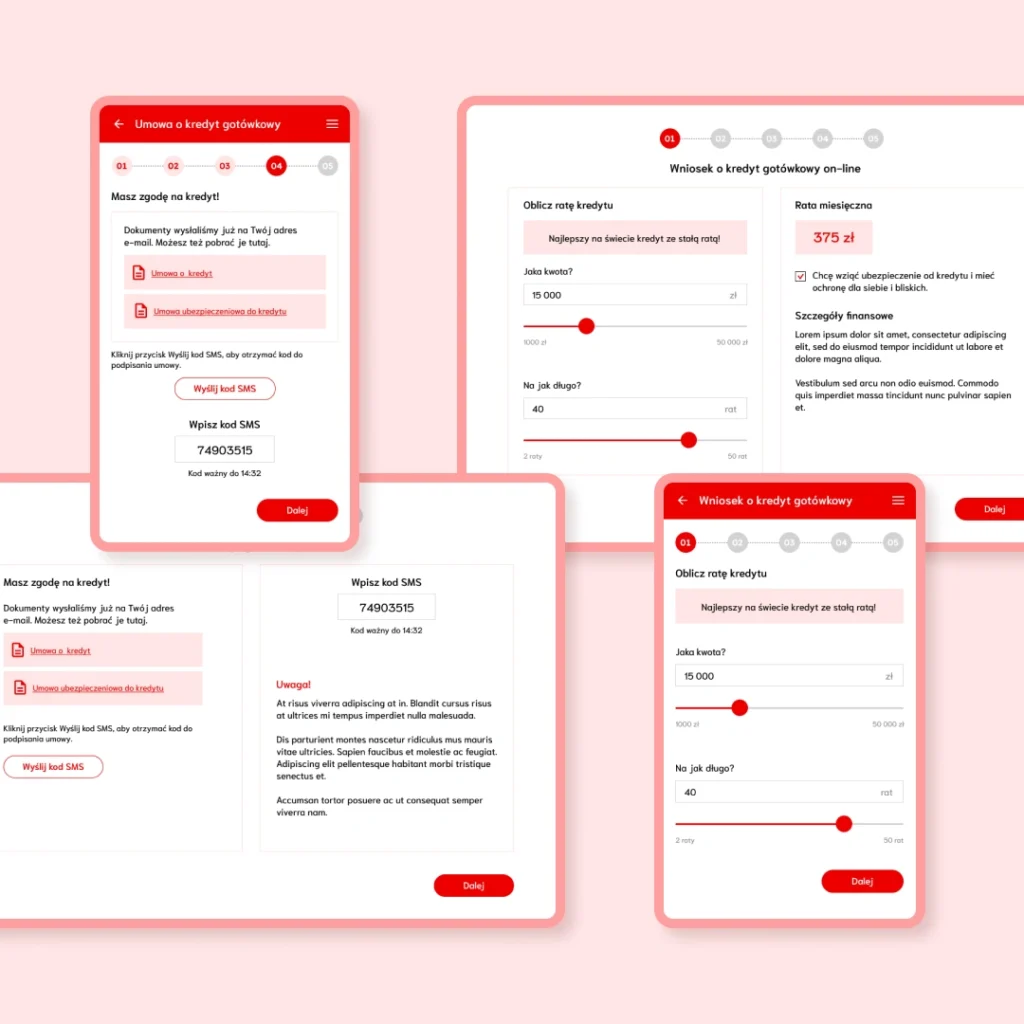

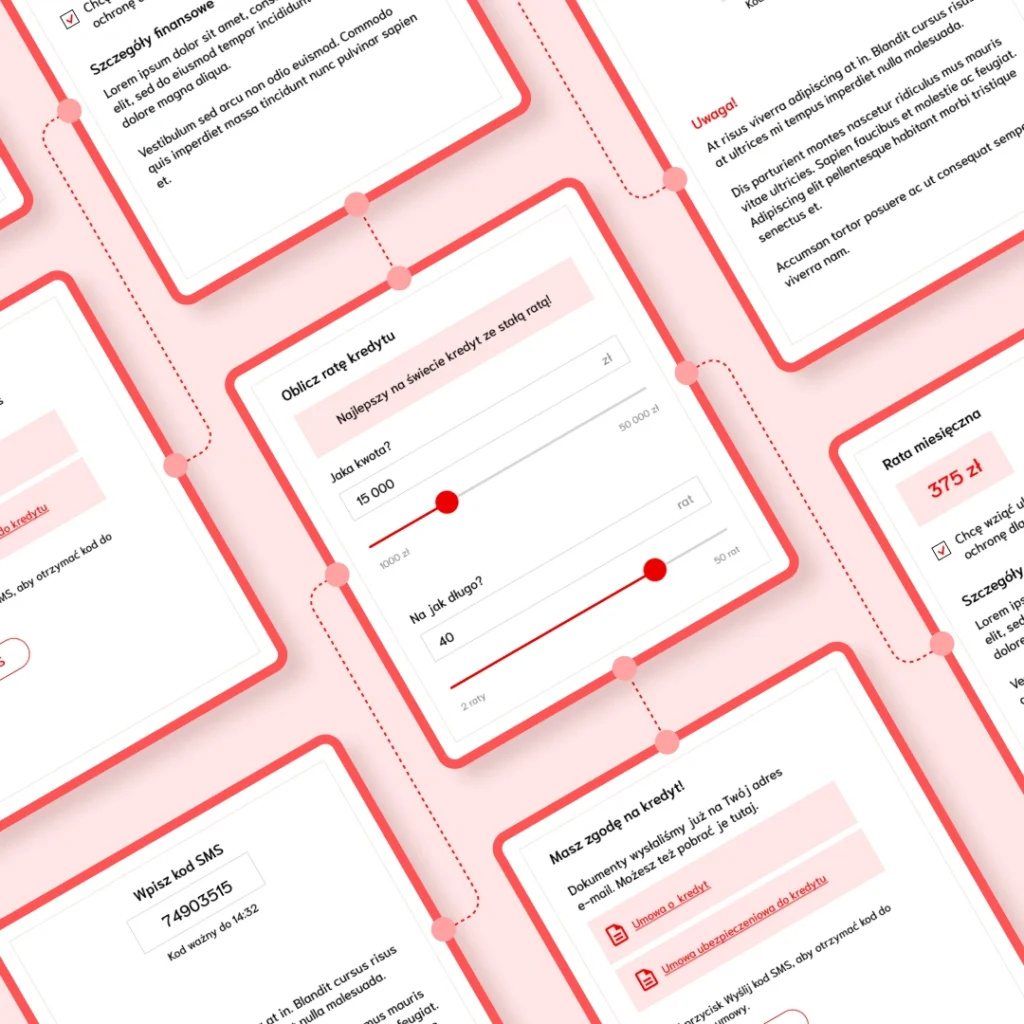

Analysis of system requirements for two independent solutions: an instalment loan application system and a cash loan application system.

Scope and delivery model

- The Digital Banking Platform was integrated with the banking systems via a dedicated user login service.

- The use of the Service Bus service made it possible to receive data from the scoring and decision engine, to handle communication with the customer (SMS, e-mail) and to confirm the status of payments used for identity verification.

- Process management was carried out using the Camunda engine.

- The use of a modular and scalable architecture enabled the Digital Banking Platform to be adapted to the bank’s dynamically changing business needs in an efficient and timely manner.