CHALLENGES

Are you losing customers due to a slow and complex loan process?

From our work with banks, we see recurring barriers that slow down loan digitalisation. If the issues below sound familiar, you’re in the right place.

-

The process takes too long. Loan decisions can take days, causing many customers to drop out before completing the journey.

-

Costs keep rising. Manual handling and fragmented systems increase workload and generate additional expenses.

-

Sales channels are inconsistent. Customers start online but end up in a branch… or choose a competitor’s offer.

-

Sales potential is wasted. Lack of personalisation, no real-time data, and ineffective cross-selling limit performance.

-

Regulations slow progress. Every change requires additional analysis, testing and approvals, delaying innovation.

Digitalisation of Cash and Instalment Loans

We provide a ready-made loan process — proven, scalable, and quick to launch in your bank.

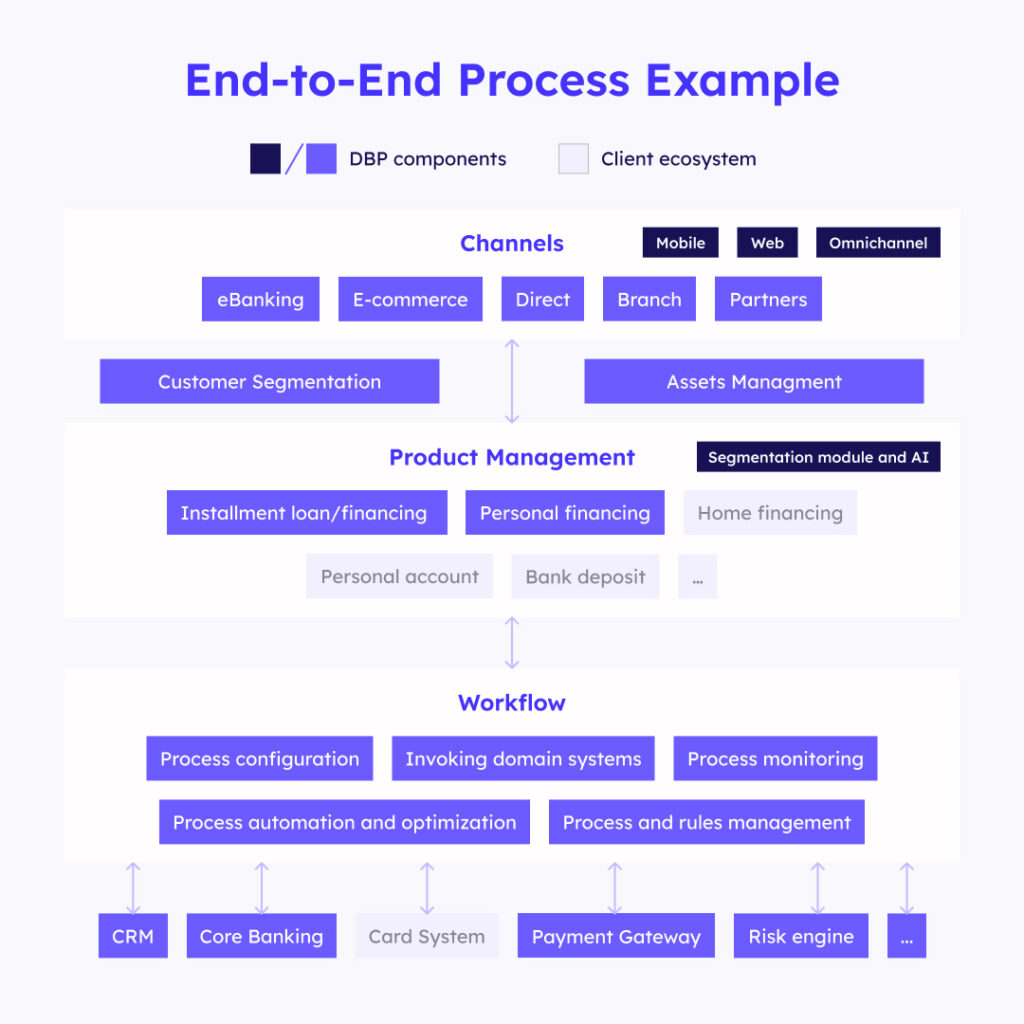

It is powered by our proprietary solution: Altkom Digital Banking Platform (DBP), designed for the digital sale of banking products.

DIGITAL BANKING PLATFORM

Key capabilities

Deliver a consistent, seamless experience across every channel: online banking, mobile app, branch, e-commerce, call centre, and external partners.

Result: broader reach and greater convenience for customers.

PARTNERSHIP

Experience our capabilities in practice

-

Meeting

Discuss your bank’s needs and challenges in loan digitalisation.

-

Presentation

See how the digital loan process works on the Digital Banking Platform — step by step.

-

Proposal

Receive a tailored implementation concept, aligned with your systems, processes, and business goals.

Filip Wachowiak

Business Development Manager