AI in the claims

settlement process

Use AI to automate claims decision recommendations. Speed up case resolution, cut costs, and eliminate inconsistencies in claims assessment.

-

Better customer service

Faster claim resolution and more predictable outcomes.

-

Lower operational risk

Consistency in claims handling and regulatory compliance.

-

Higher workforce efficiency

Automation of routine tasks and support for claims handlers in key decisions.

CHALLENGES

Do these challenges sound familiar?

-

Growing data complexity – the volume of documents, images, and data sources grows faster than the capacity for manual analysis.

-

Cost and time pressure – the market demands faster decisions and cost reductions, which are difficult to achieve with traditional methods.

-

Inconsistent decisions and appeals – lack of process standardisation increases the risk of errors, more customer complaints, and loss of trust.

What are AI decision recommendations?

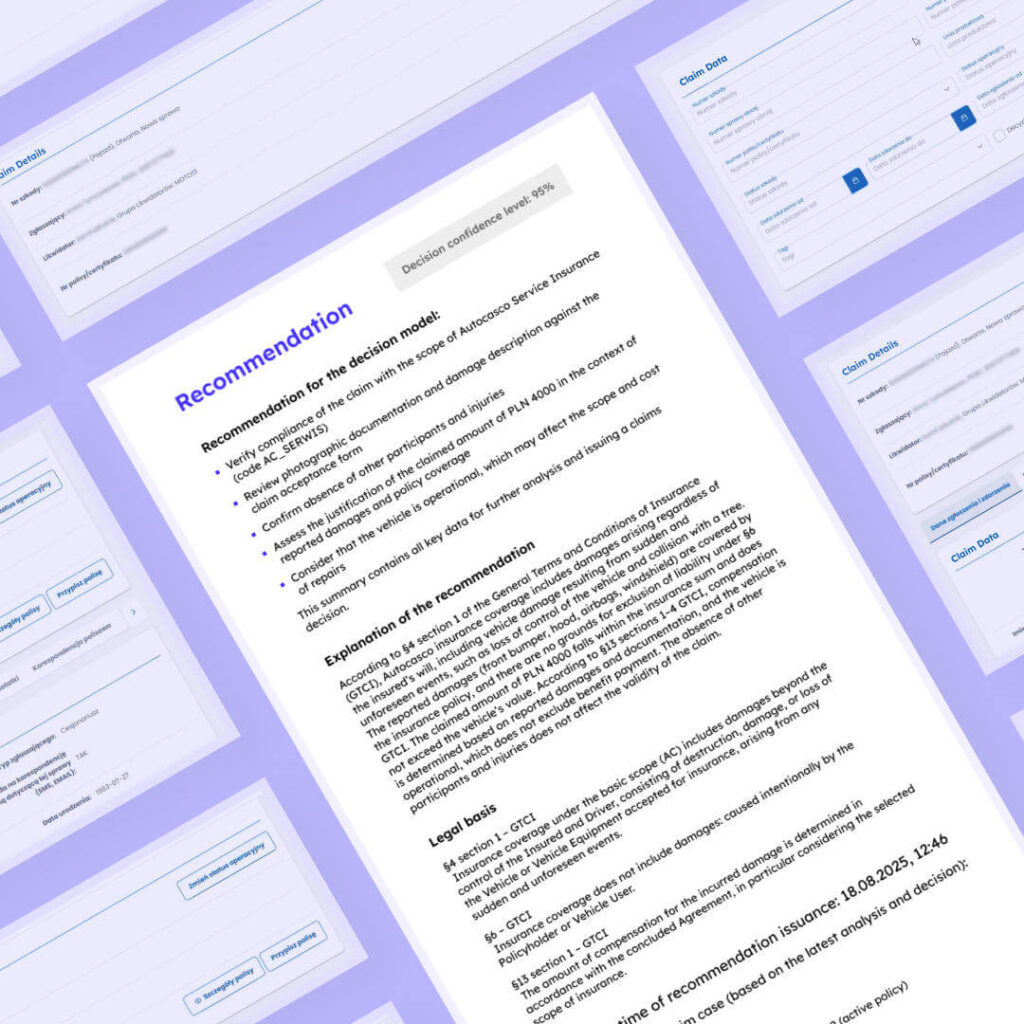

Discover a decision recommendation system for claims handlers that transforms complex data into clear and consistent business guidance.

Instead of hours of manual review, managers and teams receive a structured case summary, risk assessment, and a suggested decision — all with full transparency and auditability.

BENEFITS

What do you gain with AI support?

-

Case summary – key policy, claim, and document data in a single view.

-

Error detection – quick identification of gaps or contradictions in documentation.

-

Decision recommendation – suggested approval, rejection, or denial with full justification.

-

Law-based decisions – every recommendation is backed by legal references.

-

Confidence level – indication of when AI recommendations can be trusted and when additional verification is required.

-

Suggested amount – recommended compensation value with rationale.

-

Document and image analysis – automated extraction of data from files and photos (OCR).

-

Claims handler support – less routine work, more time for customer care.

WHY IT MATTERS

One solution, all claims, shared benefits

-

For all claim types

Motor, health, and property claims supported by universal document and data analysis mechanisms.

-

For end customers

Better experience through faster, consistent, and well-justified decisions.

-

For Insurers

Higher predictability, fewer appeals, and real operational cost savings.

-

For claims handlers

Daily support, reduced stress, and more time for cases that require empathy and expert knowledge.

Book a demo

Filip Wachowiak

BUSINESS DEVELOPMENT MANAGER

Write to us or call

Fill in the form and let us know about the project you are planning.