Automation of up to 80% of medical expense refund cases

OUTCOMES

Results of partnership

Optimisation

Our PoC system allows the workflow engine to model processes without the need for development.

Flexibility

Implementing the PoC opens up new avenues for claims processing without the need to replace the core system.

Automation

Thanks to its AI model, the PoC can process up to 80% of the most common queries automatically.

PROJECT

Genesis and business expectations

Over the course of several projects we worked on for insurance companies, we couldn’t help but notice a certain problem that the industry was facing. Our clients increasingly spoke of the limitations of the systems they used to handle requests, claims adjustment and payouts, especially their lack of process flexibility. This made us realise that more and more insurance companies now faced growing claims processing costs and standard software did nothing to facilitate easy process optimisation and automation without additional development.

On top of that, customers frequently don’t fill out the relevant online forms, but request cost refunds via e-mail. This makes it even harder for claims adjusters, who then need to verify the content of each e-mail, classify the case, validate the data manually and introduce/register the new request in the system.

We delegated the problem to our Research and Development (R&D) department, which designed and developed a flexible PoC patient claim registration system to speed up insurance payouts (for medical cost refund requests). The solution was developed based on selected components from our proprietary insurance system (Altkom Insurance Suite, especially the AIS Claim Centre layer), a workflow engine and the potential of generative artificial intelligence.

PROJECT TIME

One month

INDUSTRY

Insurance, Medicine

COUNTRY

Poland

SERVICES AND SOLUTIONS

TECHNOLOGIES

Camunda

AWS Bedrock

AWS Sagemaker

Who have we helped?

The project was carried out as part of R&D at Altkom Software, based on the data and in response to the problems reported by several current and potential clients, i.e. large insurance companies providing, e.g. health insurance services.

Business challenges

- Building an application to process medical cost refund requests filed via a digital form;

- Increasing the flexibility and autonomy of insurance companies in terms of claims process optimisation and automation;

- Automating the registration and processing of cost refund requests filed via e-mail.

ACTIONS

Project execution process

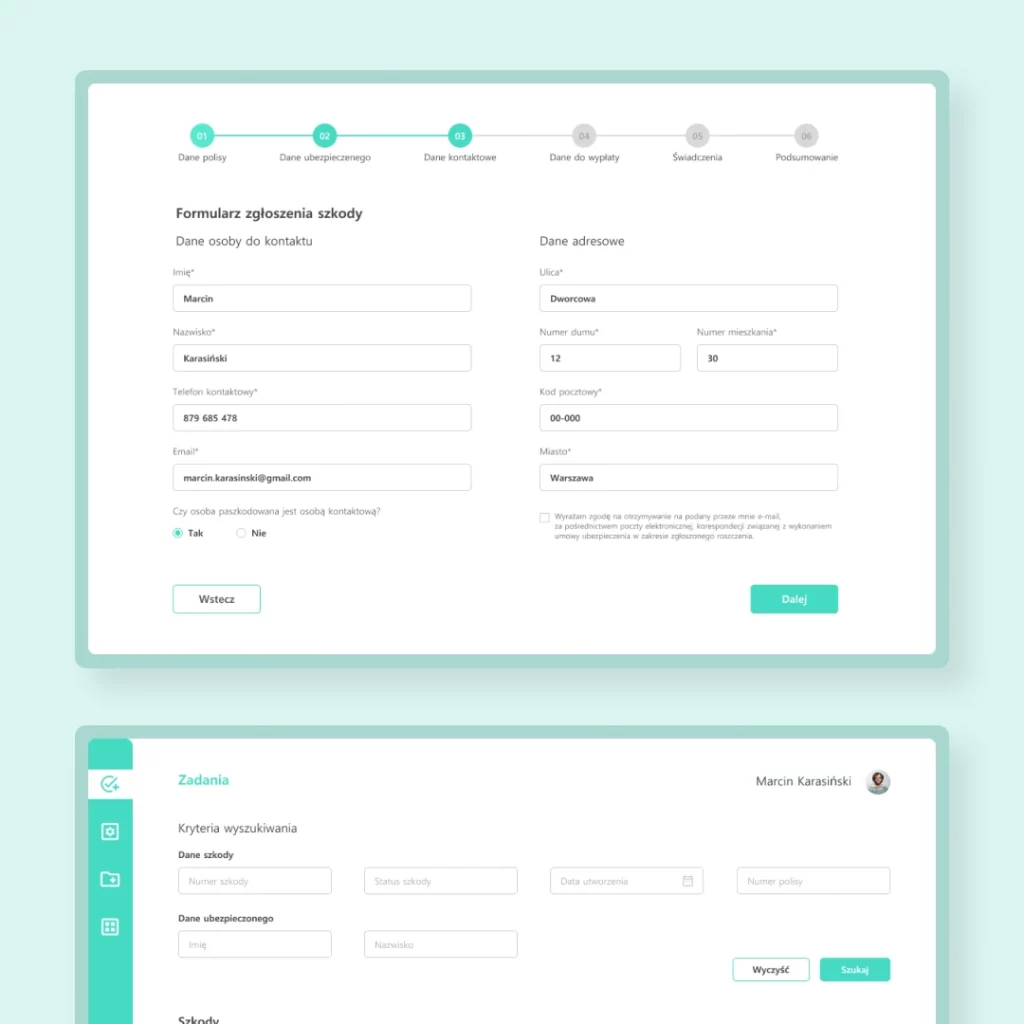

Converting the paper treatment refund request form into a digital format.

Scope and delivery model

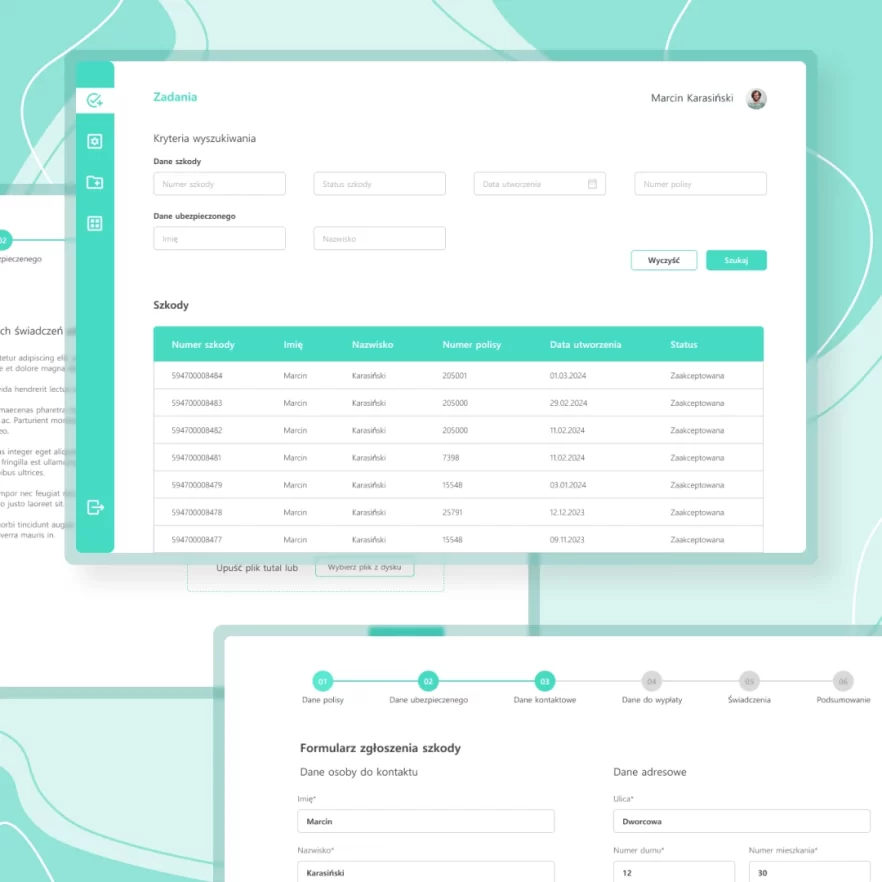

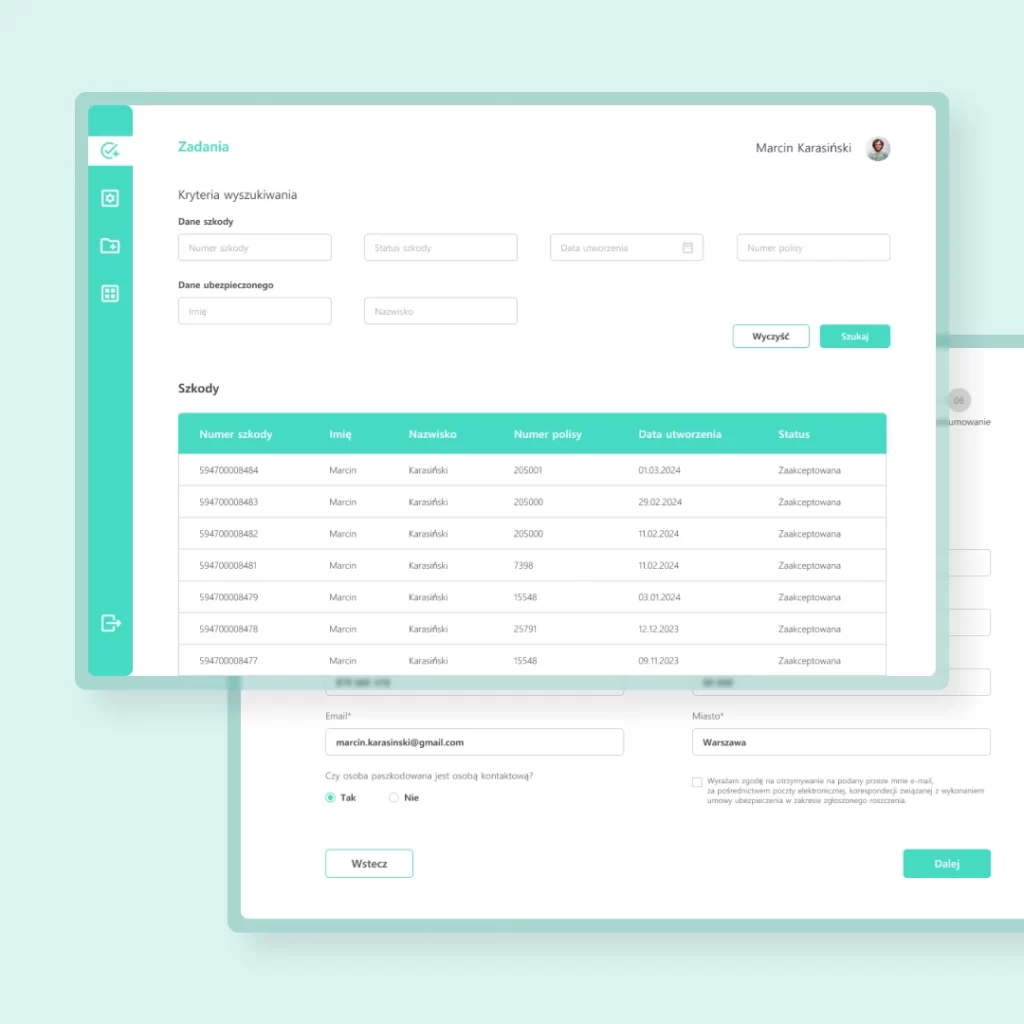

As part of our PoC system, we designed a digital user pathway: an online form based on a traditional medical cost refund request form. Once they fill out and submit the form, users get an e-mail message that confirms their claim has been registered. At the same time, the request is filed in the back-office app designed for the claims adjusters of the insurance company.

Since the system also includes a workflow engine component, the insurance company can flexibly define the process pathway end-to-end and choose its steps at will, based on decision rules that include spending limits and product rules. In this way, the request is either automatically passed on to payout or assigned to a claims adjuster and forwarded for subsequent review to the app. Company employees can also use the app to preview accepted and rejected requests and claims.

Moreover, the system was reinforced with a trained generative AI model that automates the processing of cost refund cases filed by e-mail rather than through the online form. Artificial intelligence looks through customer messages to find the information necessary for a claim report, i.e. as if it independently fills out a request form on behalf of the patient. In this case, the AI-generated request is also forwarded to the app for review by an adjuster (who will verify and confirm it or request more data, which were not provided by the AI).